Home

No more epics.

Just awesome software.

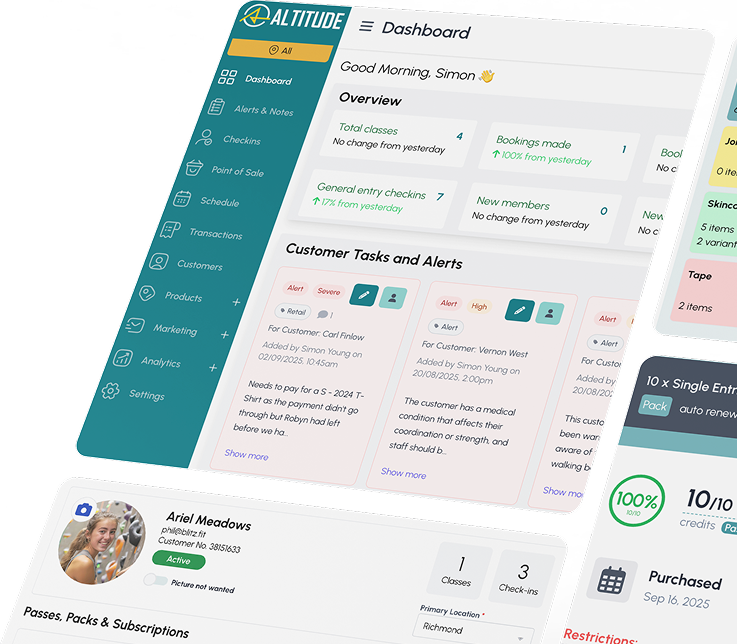

The all-in-one cloud based climbing gym management software built to simplify operations and grow your business.

No more epics.

Just awesome software.

The all-in-one climbing gym management software built to simplify operations and grow your business.

We know what it takes to run a successful climbing gym

It’s about more than just getting holds on the wall. That's why Clava handles every aspect of your business operations.

We can help you…

Increase revenue

Drive sales with discount and loyalty programs, revenue protection tools, and smart payment tech to cut failed payments. Optimized user experience reduces bounce rates and boosts conversions.

Cut Costs

Replace multiple systems with one fully integrated platform. Lower software spend, reduce staff onboarding and training time, simplify accounts, and eliminate inefficiencies.

Improve Customer Experiences

A modern, intuitive platform designed for your gym’s unique product ranges, enhancing the online journey from booking to purchase and empowering customers with self-serve options.

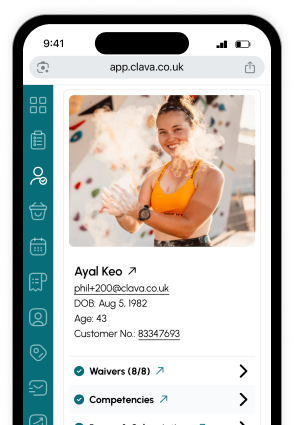

Reduce Risk

Manage safety and compliance with ease. Built-in waivers, competencies, and configurable tools keep you aligned with industry standards while reducing liability.

CRM

Waivers & Competency

Scheduling & Booking

Membership & Pricing

Admin and Customer Self-check in

Inventory Management

Integrated Point of Sale (POS)

Customer Sales Portals & Widgets

Email Marketing

Reporting & Analytics

Location and Space Management

Multi-location support

Corporate Accounts

Autonomous Access Control

Instructor Portal

Team & Role Management

Alerts, To-dos and Notes

Third-Party Integrations

Make a lasting positive impact on your business, your team, and your customers.

Growth often requires a change. Our beta is dialed in! We'll make the change seamless.

01

Setup & Integration

We handle the entire migration process, ensuring zero downtime and seamless data transfer.

02

Data Migration

All your existing member data, payment history, and settings transfer safely to our cloud-based platform.

03

Go-Live & Support

We’re with you every step of the way, from launch day to ongoing optimization

Everything you need, in one price.

We believe every operator, regardless of size, should have access to all the features they need to grow their business, without unnecessary or complicated pricing tiers or restrictions.

"The Clava team created a customised system that seamlessly integrates with our website, fulfilling our specific needs. The software and hardware were implemented by an excellent development team, allowing us to confidently meet all our insurance and safety requirements through automated processes. Clava helped us pioneer a new model for climbing gym operations in the UK."

Owner Operator

LUMA

“The switch to Clava was seamless, with plenty of support on hand to ensure a smooth transition. Clava has been purpose-built for climbing centres, and it really shows - the platform fits our needs perfectly. With Clava in place, we feel confident and fully supported in our plans for future growth.”

Managing Director

The Ridge

"Clava's team transformed our business by making a complex CRM migration manageable. Their exceptional support and proactive problem-solving turned challenges into smooth transitions, and they continue to develop valuable features that enhance efficiency and safety. Clava has empowered us to streamline operations, expand our offerings, and eliminate booking system frustrations."

Head of Operations

The Font